Newsroom

Filter

Category

Awards & Recognition

CARF Accreditation

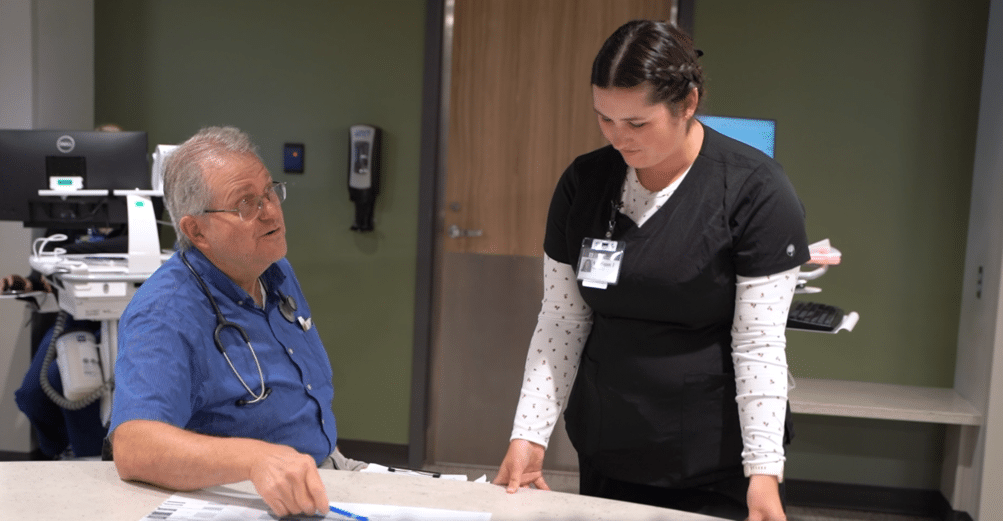

Madonna Rehabilitation Hospitals is dedicated to providing high-quality services to our patients. We are equally dedicated to upholding high standards of quality in our business practices. We are proud to demonstrate this dedication by obtaining CARF accreditation for the programs at our Lincoln and Omaha campuses.

Vapotherm Center of Excellence

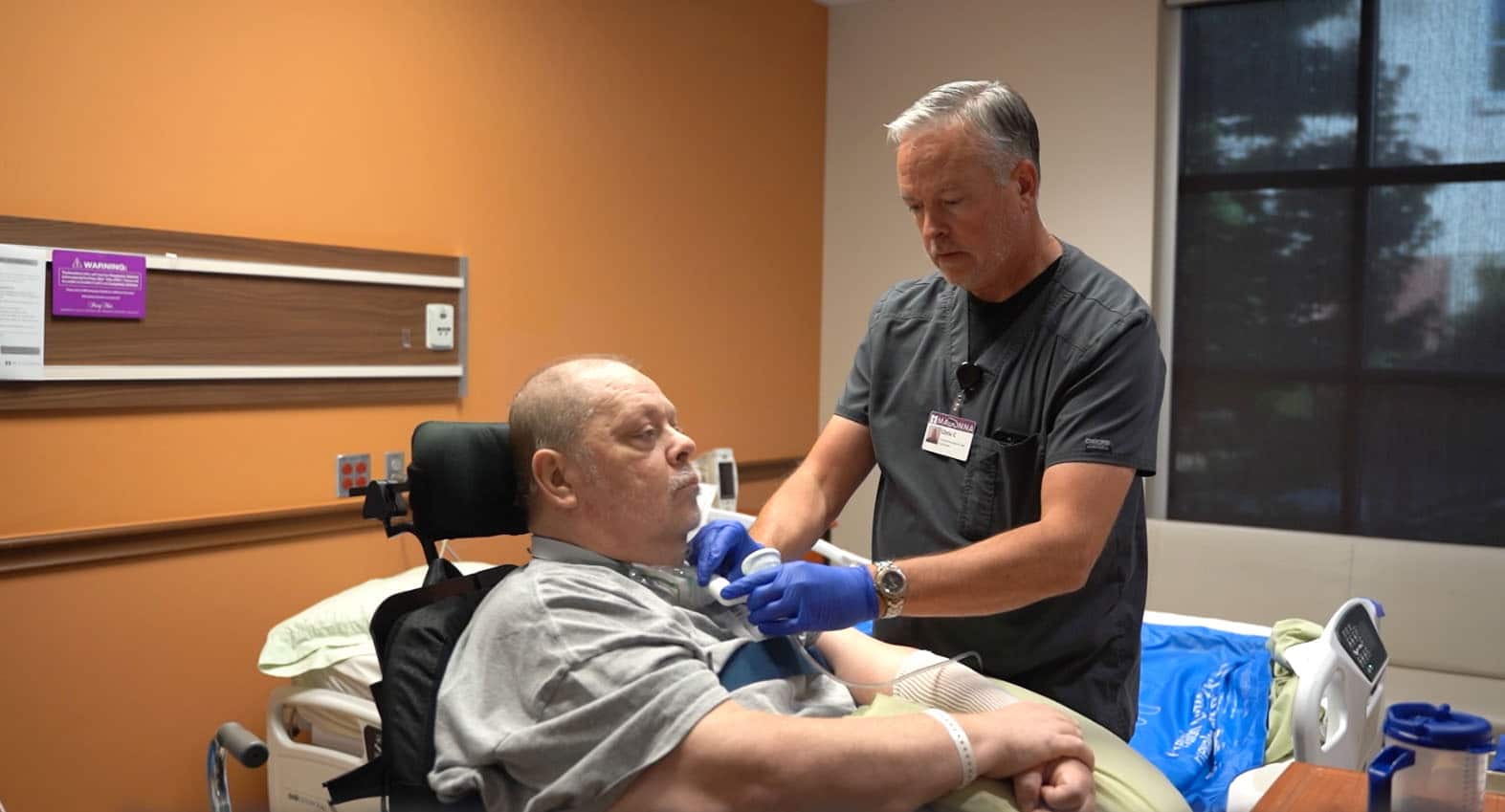

Madonna Rehabilitation Hospitals has received the Vapotherm Center of Excellence designation for its use of Vapotherm's technology in ventilator and tracheostomy weaning protocols. It is the highest recognition a facility can receive from Vapotherm, and it signifies that Madonna uses Vapotherm technology as a standard of care.

Passy-Muir Center of Excellence

The Passy-Muir Valve (PMV) is the standard of care for our pediatric and adult ventilator and tracheostomy tube patients. Passy-Muir, Inc. is committed to offering these patients a step toward independence and dignity through speech and has designated Madonna the first of just 12 Centers of Excellence in the country. The use of the PMV by our interdisciplinary team has contributed significantly to the success of our ventilator and trach tube weaning outcomes.